As the insurance industry ages, it's important for independent insurance agents and brokers to consider their plans for their practices upon their retirement. The techniques used to measure and value life insurance practices are very straightforward and dependent upon detailed company history in three areas: assets, earning value, and market value. By implementing a technology that stores all this relevant information for you, you're able to clearly define the success of your practice and get the best possible value for it when it comes time to sell. To learn more, read our latest white paper below.

Succession Planning - How Technology Increases Business Valuations

Aging Industry

It’s no secret that the insurance industry is aging. The average age of independent insurance agents and brokers is nearing 60, and many lack formal business succession plans.

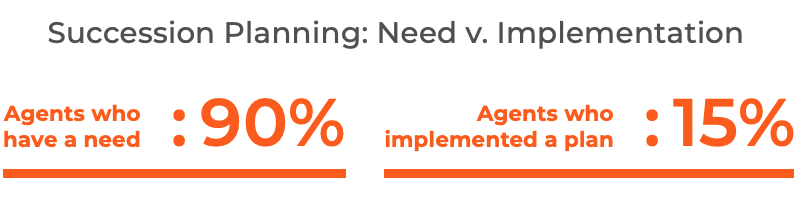

Most insurance agents agree they have an obligation to their clients to create a succession plan, but only a few have actually done it.

When the time comes, will you be ready to successfully transition your practice while protecting your clients’ long-term life insurance coverage needs?

Having the right technology in place well before retirement will ensure your practice maintains its value and that your policy owners will continue to receive the same level of service and care in your absence.

Technology Focused

The insurance industry is currently experiencing high levels of technical advancements. Cutting-edge technology is now available for almost anybody who wants to take advantage of it.

As technology further advances in the insurance industry, the role of insurance agents will become increasingly threatened, and it will be crucial for insurance agents to leverage new technologies, use data, and adopt a more customer-centric approach in order to protect customer loyalty, increase productivity, thrive in the new insurance market, and smoothly transition their client base when the time comes.

Sadly, many insurance agents are hesitant to adopt new technologies to support their inforce management needs. Not adapting to change will cost agents profits and could negatively impact their valuation. Using inforce life insurance management technology will uncover valuable insight into the potential value of their book of business.

The Bottom Line in Product Development:

Key questions the insurance C-Suite should consider

Will your organization respond to the emerging consumer desires for increased personalization and flexibility of insurance polices and services?

Are you considering knocking down traditional product line silos to adapt to a changing economy?

Is real-time, consumer activated insurance a potential capability for your company in the near term?

How will your company alter your policies and distribution system to meet evolving consumer needs and preferences?

Will you consider aligning with InsurTechs to introduce new approaches, platforms and policy designs?

Are effectively bolstering your IoT and Sensor-based strategies to modernize current product development programs?

Three Business Valuation Methods:

1. Asset-Based Approaches

2. Earning Value Approaches

3. Market Value Approaches

Valuation Methods

Several straightforward valuation techniques and metrics are being used to value life insurance practices.

Unfortunately, the industry trend has been on a steady decline for the past 30 years. Demand is not the issue; lack of profitability is the root cause for today’s lower insurance practice valuations.

As with any valuation methods, there is as much art as there is science in determining appropriate values. Potential buyers are looking for opportunities to capitalize on what the seller has spent their career building. The most valuable agencies are those that can clearly illustrate the value of their current client base.

Historical numbers are easy to calculate and measure, but estimating future earning potential is often subjective and is why this ability to accurately forecast future revenue opportunities is the key to maximizing valuations.

The best way to demonstrate the value of a current book of business is to provide the potential buyer with identified sales opportunities and a proactive policy monitoring process that will help ensure current clients will remain loyal customers.

Technology built for Succession Planning

Proformex is an inforce policy management platform that saves time, reduces cost, and delivers a more consistent policy monitoring and reporting client experience that consolidates inforce policies and identifies sales opportunities.

To learn more about how Proformex can help with succession planning, visit our website.