As new technologies begin to surface within the marketplace, it's becoming increasingly important for agencies to identify and explore ways to implement these tools and resources for the benefit of their agents. Agents are shifting their focus from commission plans to relationships with their clients, so the most successful agencies will be the ones who adopt cutting-edge technology that can support their agents and ultimately provide the best experience possible for clients. To learn more, check out our latest white paper.

- Assess their strategy

- Place technology at the heart

- Improve the agent experience while removing inefficiency

- Identify and prioritize the areas in their practice that cause the most friction between themselves and the agents they support

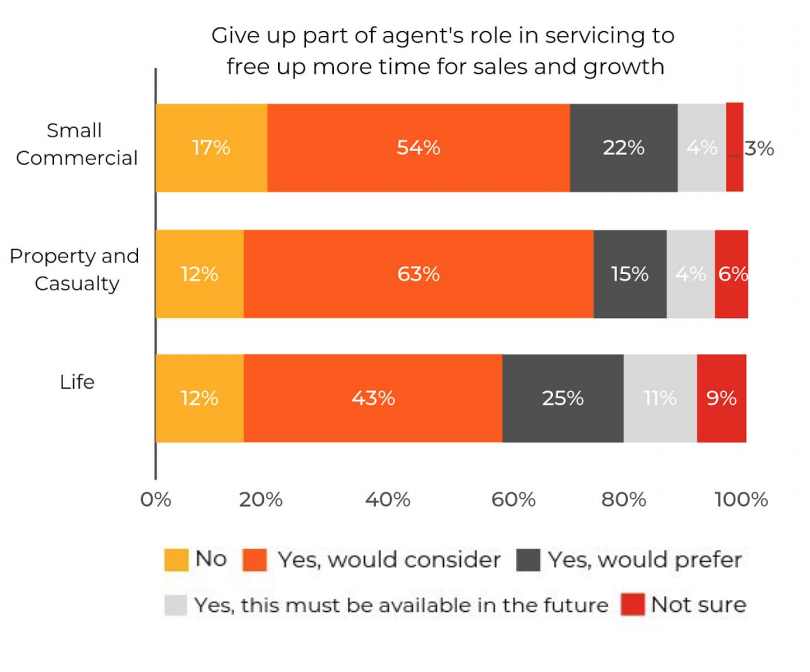

Below is a recent digital survey of insurance agents performed by Ernst & Young. Topics included the future of agents, digital ambitions, assessment and perceived value of carriers and desired products. The findings focused on trends and differences in the United States.

77% of agents surveyed believe that the servicing of inforce policies is one such area that is a definite pain point for them, because they feel constrained in their own ability to invest in infrastructure and are looking for support.

This presents a huge opportunity for GAs that can adapt and can provide post-sale support for ongoing policy monitoring.

With changes in state insurance regulations, and increased product performance concerns, GAs that offer post-sale life insurance management technology will enhance their agent relationships and increase their salesforce while reducing policy service effectiveness.

GAs who have been offering inforce policy management services are recruiting new producers and benefiting from increased production, but this has required a substantial financial commitment in information technology, software and post-sale expertise.

Technical innovation and advancement are each GA's responsibility. While carriers may provide portals, platforms or tools, it is crucial to continually evaluate each of your customer, employee and agent touch points. Maximizing digital platforms will enable smoother operations, reduce costs, and produce better servicing for agents.

GAs are in a unique situation right now. They are at the precipice of an emerging wave of digital tools that will disrupt much of their business.

Those who succeed will be the ones that adjust their business to use technology to better serve employees, agents and customers.

General agencies need to make forward progress on inforce management to stay competitive. The key to finding the right solution is to evaluate a platform that automates inforce policy monitoring and annual reviews, identifies new business opportunities, and generates client-ready reports which provide additional value to the agents you support.

To learn more about how Proformex can help with inforce management, visit our website.